Definition of Money Multiplier

The cash multiplier is the quantity of cash that banks generate with every greenback of reserves. Reserves is the quantity of deposits that the Federal Reserve calls for banks to preserve and now no longer lend. Banking reserves is the ratio of reserves to the full quantity of deposits.

The cash multiplier is the ratio of deposits to reserves within side the banking system. Why is that this important? Let’s test an instance to demonstrate the electricity of banks to actually create cash out of skinny air.

Imagine which you are president of a huge financial institution. The Fed calls for which you preserve 10% of your deposits in reserves, a reserve ratio of 1/10. This way that for every $1.00 of deposits, you may simplest lend out $zero.90. The overall price of your financial institution’s deposits is $100,000,000. You need to maximize your financial institution’s profits, so that you mortgage out all of the $90,000,000. All of sudden, you’ve got simply improved the deliver of cash from $100,000,000 to $190,000,000!

Here’s how you probably did it.

Your depositors nevertheless have $100,000,000 with you, however simplest on paper. They can are available any time and get their cash. However, on account that now no longer all of us wants, or needs, their cash on the identical time, your reserves of $10,000,000 will cowl the ordinary call for for withdrawals.

At the identical time, you’ve got got distributed $90,000,000 in mortgage finances for your debtors – that is actual cash going out the financial institution’s door. Your debtors will spend that cash on houses, cars, factories, and machinery, amongst endless different purchases. The dealers who get hold of the loaned cash in change for his or her items or offerings will deposit their sales in banks. And of course, the banks will flip round and mortgage out every other 90% of that $90,000,000, and the cycle will begin over again.

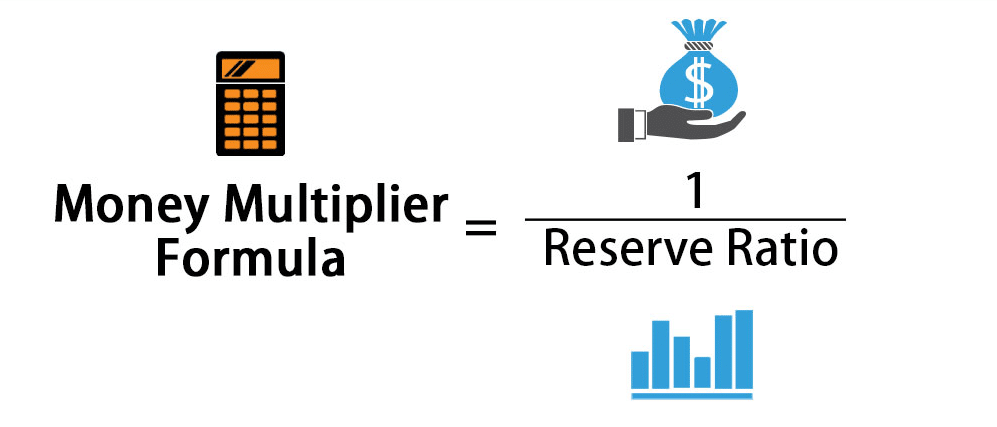

So, what does this ought to do with the cash multiplier? The cash multiplier will inform you how rapid the cash deliver from the financial institution lending will grow. The better the reserve ratio is, the much less deposits may be to be had for lending, ensuing in a smaller cash multiplier. Now, let’s have a look at a way to calculate the cash multiplier.

Understanding the Multiplier Effect

Generally, economists are normally the maximum interested by how capital infusions definitely have an effect on earnings. Most economists accept as true with that capital infusions of any kind—whether or not it’s on the governmental or company level—may have a wide snowball impact on numerous factors of financial interest.

As its call suggests, the multiplier impact affords a numerical price or estimate of a magnified anticipated growth in earnings according to greenback of funding. In general, the multiplier utilized in gauging the multiplier impact is calculated as follows:

The multiplier impact may be visible in numerous exceptional sorts of eventualities and utilized by a number of exceptional analysts while studying and estimating expectancies for brand spanking new capital investments.

Example of the Multiplier Effect

For instance, expect a business enterprise makes a $100,000 funding of capital. To extend its production centers. So one can produce extra and promote extra. After a yr of manufacturing with the brand new centers running at most capacity. The business enterprise’s earnings will increase with the aid of using $200,000. This way that the multiplier impact become 2 ($200,000/$100,000). Simply put. Every $1 of funding produced an extra $2 of earnings.

Many economists accept as true with that new investments can pass some distance. Past simply the outcomes of a business enterprise’s earnings. Thus, relying at the kind of funding. It could have extensive outcomes at the financial system at huge. A key guideline of Keynesian financial concept. It is the belief that financial interest may be without difficulty inspired. With the aid of using investments inflicting extra earnings for companies, extra earnings for workers, extra deliver, and in the end greater mixture call for. Therefore, on a macro level, exceptional sorts of financial multipliers may be used to assist degree the effect that adjustments in funding have at the financial system.